Contact Us: contact@tolaga.com

August 2021

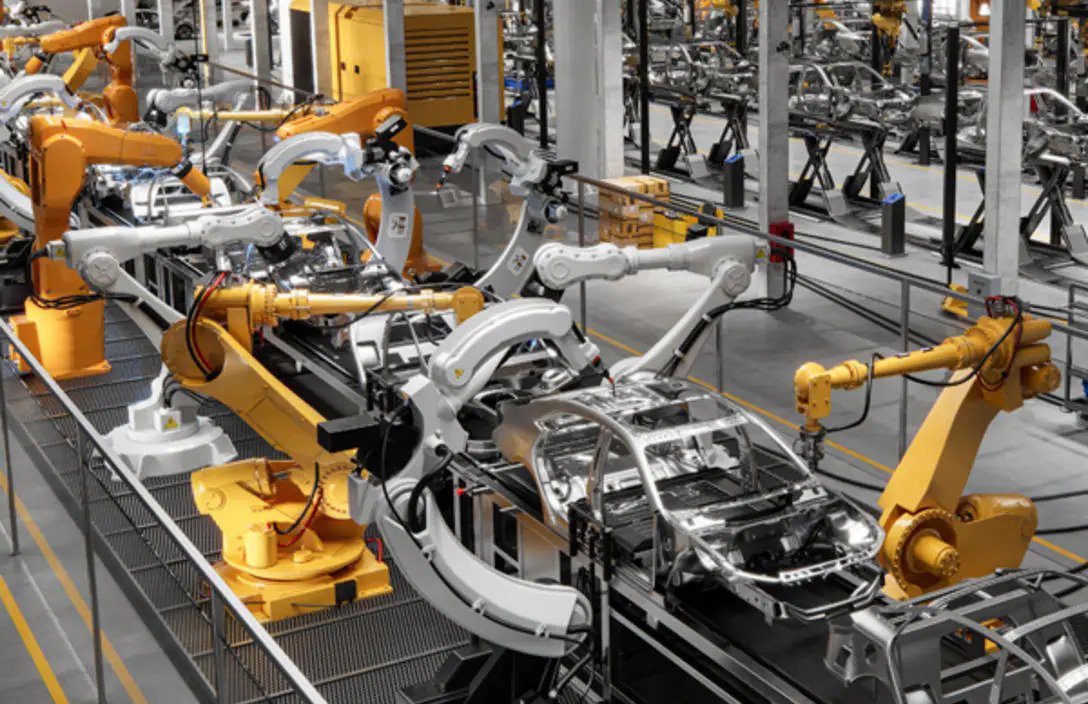

The automotive industry is experiencing tremendous disruption due to accelerated demand for electric vehicles (EV), new platforms and services, and sustainable manufacturing practices. Carmakers are upgrading existing manufacturing facilities and building new factories to support sustainable EV vehicle production combined with maturing internal combustion engine (ICE) vehicles. With these upgrades, carmakers developing new capabilities, such as EV battery and powertrain production, are implementing targeted Industry 4.0/smart manufacturing capabilities to enable data management, robotics and automation, and real time monitoring and control. These capabilities require robust network connectivity. Today fixed connectivity is typically favored as the primary connectivity for non mobile assets. WiFi is used in some cases for mobile equipment and backup connectivity for non mobile assets. 5G is gaining some traction in automotive manufacturing facilities, which we expect will accelerate as private 5G networking matures and 5G becomes better aligned with the specific use cases for automotive manufacturing. Notable examples include:

Given its capabilities, 5G should already have a more robust positioning for automotive manufacturing but is hindered by competition from fixed and WiFi networking. Although WiFi lacks performance and fixed networking lacks flexibility, they are both well understood and tend to be favored. Moreover, 5G has been spearheaded by telecom companies, with a long legacy with consumer broadband services. We believe that this causes a problematic 'chameleon like' positioning of 5G, which emphasizes its technical prowess, rather than the unique use cases that it enables for in vertical markets like automotive manufacturers.

Automotive manufacturing is massive. Carmakers, including Volkswagen Group (VW), Toyota, Daimler, Ford, Honda, and General Motors (GM), are amongst the ten largest discrete manufacturers globally. The automotive industry is well established and highly competitive, with unique product development and manufacturing techniques that have been refined over decades. However, the industry is experiencing tremendous disruption with the growing popularity of electric vehicles (EV), efficient vehicle platforms, connected vehicle services, and assisted and autonomous driving. The industry disruptions are illustrated by Telsa's market valuation, which surpassed Toyota in July 2020.

The automotive industry has responded to market disruptions with radical strategies to embrace electric vehicle technology and sustainable manufacturing practices with software and service-centric vehicle solutions. These strategies leverage Industry 4.0 and smart manufacturing capabilities, which are prioritized for key strategic objectives without creating unnecessary commercial and operational risks.

Industry 4.0 requires reliable network connectivity to digitally enable machines and other infrastructure on the factory floor. Today the lion's share of network connections are fixed to ensure highly reliable connectivity. Wireless technology such as Wi-Fi and 5G provides connectivity for mobile equipment, such as mobile robots, and for secondary backup connections for non-mobile equipment. 5G includes broadband, ultra-reliable-low-latency (uRLLC) and massive machine type (MTC) connectivity, and private networking capabilities to support many of the requirements for manufacturing facilities. This report investigates carmaker Industry 4.0 strategies and digital use-cases that create potential opportunities for 5G.

Over the decades, automotive manufacturing has evolved with 'sustainable innovations' to optimize production and address changing customer demands. Carmakers were amongst the earliest companies to adopt robots, and as an industry, are the largest share of robotic technology. The automotive industry is highly competitive. While carmakers are eager to improve operational performance and efficiencies and trial new and innovative solutions, well-established principles typically underpin their technology investments. For example:

While automotive manufacturing will retain many of its hallmark characteristics in the foreseeable future, carmakers are developing new and disruptive manufacturing strategies for the EV market. In recent years EV market demand has accelerated and benefited from Telsa's success and global interest in sustainability initiatives to reduce greenhouse gas emissions. Over the next ten years, the global EV market will have a 20 percent cumulative annual growth rate (CAGR) to equal the Internal Combustion Engine (ICE) vehicle market by 2030.

Even though EV popularity is increasing, EVs are still considerably more expensive than internal combustion engine (ICE) equivalents and lack adequate charging infrastructure in most countries. Approximately half of the bill-of-materials (BOM) for a typical EV is for the electric power train, of which 30 percent is for battery technology. The average ICE power train costs less than 20 percent of a typical vehicle BOM.

Significant research and development and manufacturing efforts focus on enhancing EV battery technology's charging rate, longevity, and cost to reduce EV costs and improve driving range. Considerable progress has already been made and enabled an 85 percent improvement in EV battery costs since 2010, which according to Bloomberg reached an average of USD 137 per kWh in 2020. Average battery costs must be below USD 100 per kWh for EV and ICE vehicles to have price parity. Carmakers believe this is achievable by 2025. Battery cost savings and performance gains come with improved supply chains and design and manufacturing techniques. Further improvements will come as new technologies, such as solid-state battery designs, emerge.

As EVs become more cost-effective, ICE vehicles will likely become more expensive with stricter emission controls, particularly in markets with clean-energy electricity production.

Increased EV market demand is particularly disruptive to manufacturing, requiring new factories and upgrades to existing facilities. As manufacturers embrace EVs, they must also pursue parallel strategies to refine and optimize ICE-based products, which will be the 'cash-cows' for carmakers during the next decade. During its July 2021 Strategy Day, VW summarized its product strategies with two parallel paths: the so-called 'old-auto' and the 'new-auto'. VW is responding to expectations that battery EVs (BEV) will represent 50 percent of the global market by 2030. Like most other carmakers, VW is gearing up for EV growth. VW also plans to target software and service opportunities that capitalize on critical capabilities, such as vehicle connectivity, assisted and autonomous vehicle control, and digital twinning.

Industry 4.0 was coined in Germany over a decade ago to describe the digital transformation of manufacturing. It incorporates the notion of smart-manufacturing and strives for factory convergence with product lifecycle and supply chain activities. Industry 4.0 capitalizes on factory instrumentation with the IoT, AI, data analytics, and connectivity as core enabling technologies. Increasingly, 5G is positioned as a complementary technology for Industry 4.0 because of its ability to ease connectivity challenges with increased agility and flexibility. Various Industry 4.0 and 5G initiatives for the automotive industry have been trialed and implemented. Several recent examples include the following:

Industry 4.0 initiatives include diverse use-cases that generally include three overlapping categories: Data Management and Artificial Intelligence (AI), Real-time Monitoring and Control, and Robotics and Automation.

Data management and AI are pervasive and capitalize on machine data, industrial IoT instrumentation and management tools, and extensive connectivity to harvest, manage, monitor, and act upon data collected from manufacturing environments. However, machine data and protocols are typically proprietary and have siloed operating environments that impede Industry 4.0 efforts. As a result, carmakers have a variety of programs to eliminate data silos in their manufacturing environments. For example, BMW plans to use OPC-UA to integrate machine data in its factories, and VW's announced factory upgrades include extensive data standardization efforts.

Real-time monitoring and control and robotics and automation applications require ultra-reliable and low-latency connectivity. Commonly fixed connections are used to reliably connect non-mobile equipment, sometimes with wireless (Wi-Fi or 5G) backup. However, fixed connections lack scalability and agility and cannot connect mobile equipment, like autonomous mobile robots (AMR). 5G addresses these challenges with high bandwidth, ultra-reliable and low latency, and massive machine-type connectivity capabilities. However, some manufacturers are using Wi-Fi instead because it's familiarity and simplicity.

In April 2020, VW announced its upgrade plans for fifteen manufacturing facilities, with standardized data and analytics with integrated cloud solutions. 5G was notably absent from VW's April 2020 factory upgrade announcement. VW stated that fixed and Wi-Fi connectivity could achieve the necessary upgrades. VW has committed to using 5G in its factories and acquired 5G radio spectrum in 2019. We believe VW's April 2020 decision illustrates 5G's lack of ecosystem maturity and inadequate positioning for factory floor use cases. We expect VW to use 5G in its factories once the technology matures, particularly when its Industry 4.0 initiatives require massive machine type (MTC) connectivity.

Non-real-time data analytics can be supported with latency-insensitive connections and typically require integration with manufacturing execution systems (MES) and enterprise resource planning (ERP) systems. Companies like ABB, AVEVA, Dassault, GE, Parsec, and Siemens provide these systems. While ERP and MES systems are relatively mature, they become considerably more expansive and strategically important as carmakers pursue their Industry 4.0 efforts.

Automotive manufacturers use robotics and automation for targeted applications, such as spot-welding, internal supply chains, painting, large component assembly, and scheduled pelletizer reconfigurations. However, even with advancements in robots and automation, automotive manufacturing cannot be fully automated and will continue to depend on production line personnel for the foreseeable future.

Traditionally, robots operate in an isolated and secure environment, mainly for health and safety reasons. However, with advancements in sensors, data analytics, AI, and edge computing, industrial robots (typically with smaller form-factors) can now operate close and, in some cases, in collaboration with factory workers.

Automatic guided vehicles (AGV), which are commonly used to transport vehicle components, are being upgraded and complemented with autonomous mobile robots (AMR), which leverage fleet management solutions to provide greater operational flexibility. AMR technology uses advancements in assisted and autonomous driving technologies and are provided by a variety of companies, including ASTI ( acquisition announcement by ABB in July 2021 ), Boston Dynamics (acquired by Hyundai Group in June 2021), Continental, Desmasa (for collaborative mobile robots), InVia, KUKA, and Omron.

Ultra-reliable connectivity is crucial for industrial and collaborative robots to operate safely. Commonly fixed connectivity is used for non-mobile robots. However, wireless can provide redundant connectivity, remote user interfaces, and greater operational flexibility. Typically, Wi-Fi-type wireless connectivity is sufficient for non-critical user interfaces but inadequate for emerging multifunctional use cases requiring operational flexibility, high bandwidth, and latency-sensitive connectivity. This is creating opportunities for 5G-enabled robots. For example:

While the potential use-cases for robotics and automation are extensive, automotive manufacturers typically target scalable solutions that don't disrupt established operations. In addition, the unique characteristics of automotive manufacturing are challenging. For example, Telsa struggled to automate its more complex vehicle assembly activities, even with the most advanced computer vision and AI capabilities. Telsa found that proficient assembly workers could be significantly more efficient and reliable than the most advanced robots.

Operational downtime can be tremendously costly (i.e., USD 22,000 per minute), and many manufacturing facilities operate 24/7. The benefits of robots and automation can rapidly evaporate when outages occur. Solutions that seem compelling in technology trials might not be viable at scale, particularly if they directly impact operational continuity, and:

Both brown-field and greenfield automotive manufacturing facilities are being equipped with EV production capabilities. Carmakers also pursue innovations to drive operational sustainability, fortify and optimize supply chains, improve operational efficiencies, and upgrade products with software-centric design principles. The pace and prioritization of factory innovations vary amongst manufacturers and depend on various factors, including existing products and markets, product differentiation strategies, and overall market scale. For example, Volvo has upgraded its existing manufacturing facilities and has capitalized on the agility of its mixed-model assembly lines to enable EV production. In contrast, other manufacturers like VW are constructing dedicated EV manufacturing facilities for battery technologies, EV power trains with modular 'EV-skateboards', and EV vehicle assembly.

Volkswagen and Bosch manufacture standardized 'EV skateboards' with integrated chassis assembly modules for third parties. These skateboard modules will most likely be used by niche manufacturers or specialized vehicles lacking the scale and resources for dedicated power-train solutions. Most carmakers plan to develop their own vertically integrated solutions and differentiate their offerings with proprietary battery, power management, and motor designs. These players might shift to standardized EV skateboards if power-train technology becomes commoditized once the market matures.

EV assembly plants must incorporate changes in power-train and chassis assembly processes. Body panel production and manufacturing, body painting, and final assembly activities essentially remain unchanged. When mixed-model assembly environments combine EV and ICE manufacturing, pelletized assembly lines require additional sub-flows (e.g., high-voltage functionality). Volvo estimates that a 5 to 10 percent increase in infrastructure capital expenditures will be needed to support EV assembly parallel to its established ICE assembly lines. In addition, scheduling for mixed-model assembly lines can be challenging, particularly when there are significant variations in product volumes and configurations. These inefficiencies increase the need for effective agile manufacturing capabilities to adapt and optimize process flows.

Advancements in battery technology, production capabilities, and secure supply chains are crucial for competitive EV vehicle prices and battery production volumes to keep pace with EV market demand. Furthermore, since 70 percent of EV battery production is in Asia, factory expansions in North America and Europe are crucial.

All EV carmakers have partnerships with battery technology companies, including BYD, CATL, LG Chem, Samsung, and SKI. However, to ensure adequate supply and capitalize on potential battery technology differentiation, carmakers are expanding their supplier partnerships and battery packaging and production capabilities. For example, Tesla responded to supply challenges with Panasonic by extending its partnerships to include LG-Chem and CATL. Telsa also plans to build additional factories (e.g., Berlin, Germany) and develop its battery-cell technology in-house. In March 2021, Volkswagen Group announced plans to construct six 40GWh battery manufacturing facilities by 2030. Toyota is building battery manufacturing facilities in partnership with Panasonic and aggressively pursuing solid-state technology developments. In April 2021, General Motors (GM) and LG Chem announced plans to invest USD 2.3 billion in a battery manufacturing facility in Tennessee. In May 2021, Ford announced a partnership with SK Innovation to manufacture battery cells and arrays. In the same month, BMW also announced plans to manufacture battery cells.

Battery manufacturing accounts for 40 percent of overall battery costs and has important implications for battery performance. Current manufacturing processes lack the automation needed for battery production scale to meet growing market demands. In addition, production processes underestimate battery performance profile variations, which depend on battery cell chemistry and cell array constructions. Today carmakers typically source battery cells and complete battery products from partner suppliers. However, carmakers like VW, Toyota, Ford, and GM are advancing their battery cell and package manufacturing capabilities to improve their supply chains and create differentiated products.

We believe that carmakers and battery manufacturers will seek various digital transformation technologies to develop and expand their manufacturing capabilities to achieve product differentiation. For example, sensors with real-time feedback on the manufacturing process of battery cathodes can reduce production costs by up to 8 percent. Effective predictive maintenance can reduce the cost of EV battery cell production by 7-10 percent, with the highest impact on the coating and drying processes, followed by formation, compound generation, and aging. Smart assembly and finishing of battery cells can reduce cell production costs by up to 10 percent. In addition, agile cell assembly solutions that account for battery cell chemistry can improve battery performance by more than 15 percent.

Digital twins can track battery cells and arrays through the manufacturing and assembly processes and ongoing operations. Recent academic research projects (e.g., at Imperial College London, University of Warwick, and Beihang University, China ) have demonstrated that digital twinning support in smart battery management can enable longer battery life and faster-charging capabilities. These solutions require wide-area network connectivity, remote monitoring and control, advanced data management, and AI capabilities to support EV battery lifecycles proactively.

Automotive manufacturing is energy-intensive and consumes significant quantities of raw materials. Carmakers continually improve their processes and procedures to reduce their consumption costs and sustainability profiles. For example, according to the United Kingdom's Society of Motor Manufacturers and Traders, the average energy used to manufacture a vehicle decreased by 43.3 percent over the last 20 years. There are numerous sustainability-led initiatives that carmakers are pursuing that will drive 5G and Industry 4.0 opportunities. Two notable areas include EV battery production and energy management in vehicle assembly plants.

According to an April 2021 ABB research study, there will be a six-fold increase in EV battery demand between 2020 and 2030, which cannot be supported by current and planning manufacturing capacity. This capacity shortfall is exacerbated by complex supply chains for raw materials and over 70 percent of battery production in the Asia Pacific.

By building battery factories closer to vehicle assembly plants in Europe and North America, carmakers will have more sustainable EV battery manufacturing capabilities. But carmakers are eager to further their sustainability efforts by using renewables, smart supply chains, and smart product lifecycle management to minimize carbon footprints for battery production, optimize battery performance, and facilitate efficient battery recycling. We believe these capabilities will require a range of Industry 4.0 innovations, including real-time monitoring and control, data analytics and AI, digital twinning, and wide-area mobile network coverage.

Vehicle assembly plants have many processes with vastly different energy and raw material demands.Research conducted at the Universities of Durham and New Castle in the United Kingdom investigated typical automotive manufacturing facilities' energy consumption and carbon footprint. The researchers observed that 36 percent of the total energy consumption in a conventional manufacturing plant is associated with vehicle painting processes. The research identifies various thermal energy management solutions to minimize energy consumption. Real-time monitoring and control and data analytics, and AI capabilities could significantly improve the performance of the proposed thermal energy management solutions.

Sustainability considerations are essential for carmakers as they continue to expand their EV initiatives and scale back ICE vehicle production in line with market and regulatory expectations. Even though EVs have low operational carbon footprints, consumers, regulators, and industry watchdogs are becoming increasingly aware of EV production's carbon footprint and environmental impact. As a result, we expect consumers to increasingly favor EVs manufactured with lower environmental impact -albeit while still sporting the advanced features, conveniences, and creature comforts that consumers value. Since this will accelerate sustainability-led initiatives, we believe that it is essential that industry players fortify the positioning of 5G and Industry 4.0 for sustainability.

Automotive manufacturing is disrupted as it responds to growing EV demands to replace traditional ICE vehicles, new modular and software-centric vehicle platforms, and global sustainability demands. New manufacturing facilities are being built, and existing facilities are being upgraded. Vehicle electrification is disrupting existing supply chains and production lines for existing power-train equipment and creating tremendous demands for EV battery production.

Carmakers are pursuing digital transformation strategies with Industry 4.0 innovations to improve their manufacturing capabilities and respond to industry disruptions. However, their digital transformation efforts are punctuated by the tremendous cost of getting it wrong. Large-scale operational outages typically cost USD 22,000 per minute, and vehicle quality problems can result in vehicle recalls costs that run into the USD billions. Therefore, carmakers are appropriately cautious with their Industry 4.0 efforts, which are typically easier to implement in greenfield than brown-field manufacturing environments and easier for new product categories, such as EV batteries. Several Industry 4.0 use cases that carmakers are pursuing include:

Fixed network connections are commonplace in factory environments, particularly for non-mobile equipment with ultra-reliable performance requirements. Mobile solutions, such as mobile robots, are either supported by Wi-Fi or 5G connectivity. Many carmakers are trialing 5G technology and sometimes deploying private 5G networks. With massive factory upgrades and new factory builds planned, we believe 5G should already have a stronger foothold in automotive manufacturing. Although Wi-Fi lacks performance and fixed networking lacks flexibility, they are well-understood technologies and formidable competitors for 5G. Continued efforts to reduce 5G operational complexity and virtualize core and radio functionality are crucial to address this competition. In addition, 5G's positioning needs to change with more attention toward the unique use cases it enables rather than its technical prowess.